How to Manage Inflation at Different Ages

- Jeran Van Alfen, CFP®

- Jul 21, 2021

- 6 min read

Inflation is a buzzword right now and you most likely have felt some of the effects of increased prices firsthand over the last few months. There is no question that prices for some goods and services are higher now than they were earlier in the year. The sudden spike in inflation has some people worried about how high prices can go and how long inflationary pressures can last. When it comes to your financial plan, it is important to be aware of how inflation may impact your cash flow. In this post we will explore what moves to make at different stages of your life to protect against inflation.

A simple explanation for inflation

Inflation is the process of the gradual rise in prices over time. Because of inflation, we know that the value of our money today won’t be worth as much in the future, but why does this happen? Simply, inflation usually occurs when there is more demand than supply. External events like a disaster, trade policy change, or a pandemic can accelerate inflation because these disruptions create challenges for companies to produce enough supply to meet demand. Prices go up in order stabilize the supply/demand balance while companies and consumers adapt or adjust.

Inflation isn’t necessarily a bad thing. Stable, predictable inflation is a sign of a healthy, growing economy.

“Transitory” inflation

If you follow financial news at all, you may have heard the word. “transitory” when analysts refer to our current inflation rates. This means that most economists are expecting the recent spike in inflation to be temporary and for the rate of inflation to stabilize and return to normal in a short period of time.

There are a few reasons for this. First, when we measure the inflation rate, we usually compare prices to the same period a year ago. Right now, we are looking back to the Summer of 2020 when our economy was shut down and we were in a recession. In the summer of 2020, we experienced 3 straight months of negative inflation rates. With last year as the base rate, the spike in inflation is accentuated. However, as we move forward in time and start comparing the current inflation rate to months when our economy was growing, we expect inflation rates to stabilize.

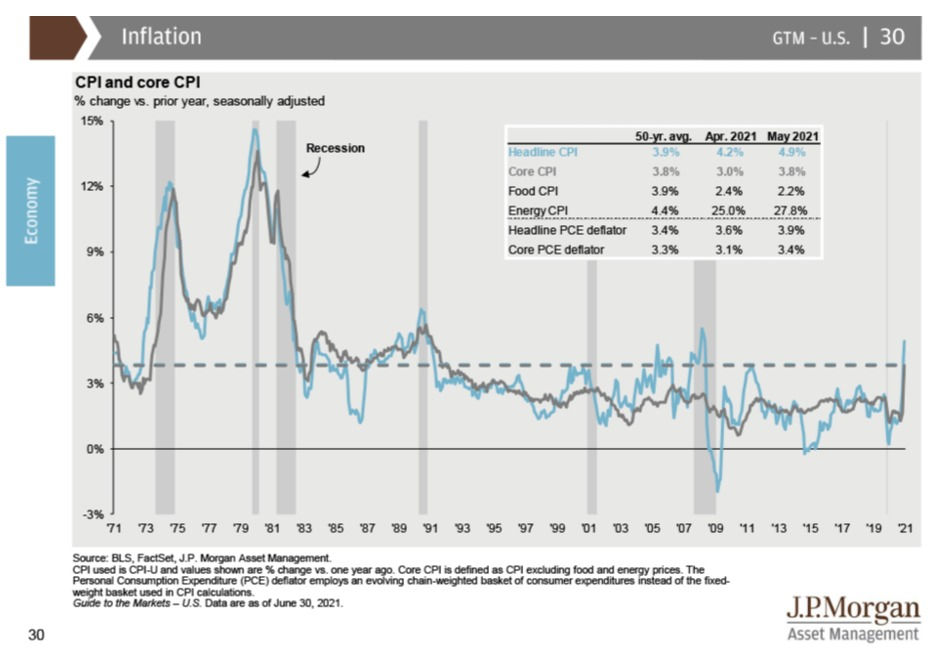

The second reason is that all of the components that have kept inflation low for the last decades are still in effect. Inflation is determined by measuring the price changes for a basket of consumer goods and services. This basket is called the Consumer Price Index (CPI). As you can see in the chart below, the average inflation rate for the CPI over the last 50 years is 3.9%. However, over the last 20 years, average inflation has been much lower at 1.98% [1]

Image Source [2]

We have been experiencing lower average inflation because globalization has led to a more competitive economic environment. Technology advances over the last 20 years have increased automation and innovation. Some call this the “Amazon effect”. These factors are still very present and are expected to increase in the future which should keep inflation in check as we have seen in recent years.

The third reason that we expect the inflation spike to be temporary is that price increases have really been driven by specific industries rather than the broad CPI. In the image below you will see that there is a difference in the inflation rate of goods that are “sticky” or tend to have permanent long-term price adjustments and “flexible” which are things tend to have short-term price changes depending on the economy. You can see that although prices have risen across the board, flexible inflation has spiked dramatically.

Inflation and your financial plan

Whenever we plan for our future, we need to be conscious of inflation. Depending on your age, you may need to consider different actions with regard to handling inflation. Here are some ideas on how to protect your finances from the effects of inflation.

20’s and 30’s

At this stage of the game, your focus is typically managing debt and accumulating as much as you can for your future. With time on your side, it is extremely important to start investing so that you can take advantage of compound interest and start growing your money. Here are 3 steps to take now:

Consider negotiating a raise. In inflationary times, costs are going up and typically wages increase as well. If you are in a position where an increase may be due, it is smart to negotiate a raise. At this stage in your career, any extra money can help you get off to a fast start toward your financial goals.

Pay extra money toward debt. If you carried debt before prices started going up, inflation has essentially decreased the value of your debt. By putting extra money toward the debt you are paying less interest over time and saving money.

Invest in the stock market. Don’t wait. You have time on your side and long-term growth in the stock market is one of the best ways to combat inflation. Consider this: Over the last 20 years stocks have produced an average annual return of 7.5% compared to 4.8% for bonds and 1.4% for cash.3 With inflation at about 2% any money that you leave sitting in a bank account for a long period of time is losing money to inflation.

40’s and 50’s

These ages are strategically important for setting up a good retirement. Here are 3 steps to consider:

Home ownership. Buying a home can be a great hedge against inflation when it comes to your cost of living. Typically, the major essential expense in our budget is housing. Rent typically spikes in times of inflation and is out of our control. Getting into a property that will build value over time can be a smart move4.

Make conscious spending decisions. At this age, we have formed money habits. Some are good and some most likely are poor. When prices increase it is a good time to review where we are wasting money. Approach your budget with the mindset of funneling your money to what really matters to you. Life is short, don’t waste money on things that aren’t important to you and look for better deals to help you get into the best financial situation possible.

Make it happen. You have built up a portfolio, now is the time to forge ahead. Look for opportunities to max out your retirement savings and for opportunities to put your capital to work in assets that will produce long-term appreciation and income for you. Real estate investments, business-ownership, side-hustles, etc. Switch your mindset from consumer to producer.

60’s and beyond

This is the time to make your money work for you instead of working so hard for your money. Here are 3 ideas that are important for a secure retirement:

Evaluate your essential expenses. It is as important as ever to know what it costs for you to live. Take action to reduce your costs. Evaluate what it will take to cover your essential expenses and figure out how to create a retirement paycheck to cover them.

Take care of your health. Make a plan for paying for healthcare. Traditionally, healthcare costs have inflated faster than other costs. While financial moves are important, the best way to combat future healthcare costs is to evaluate your lifestyle choices. Start making the changes necessary to live a vibrant, healthy life as much as possible. There are lots of things that are out of our control, so focus on what you can control.

Know the risks. A big mistake that some investors make as they mature is poor risk management. While overexposure to the stock market can leave your portfolio open to market losses, underexposure can result in losing money to inflation. This is a delicate balance. This is the time to make adjustments to your investments based on your income needs. It is also important to keep a proportion of your portfolio invested for long-term growth in the stock-market in order to provide inflation protection and keep up with increased income needs in the future.

Your financial plan should help you make decisions as you are faced with the changes that life brings. Remember that we each live unique lives, so don’t worry too much about comparing yourself to others. Make financial decisions based on what matters to you and your purpose. Need to figure out how inflation may affect your plan? Schedule a session today to get started.

Centered Financial, LLC is a registered investment adviser offering advisory services in the State of California, Utah, Texas and in other jurisdictions where exempted. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that the techniques, strategies, or investments discussed are suitable for all investors or will yield positive outcomes. To determine which strategies or investment(s) may be appropriate for you, consult your financial adviser prior to investing. Any discussion of strategies related to tax or legal planning is general and is not intended as tax or legal advice. Please consult appropriate tax and legal professionals for recommendations pertaining to your specific situation.

[2] https://am.jpmorgan.com/us/en/asset-management/adv/insights/market-insights/guide-to-the-markets/

Comments