Monday Market Review: January 5, 2026

- Investment Committee

- Jan 5

- 6 min read

Weekly Summary

In a light year-end week, economic data included slight gains in home prices, lower jobless claims, and Federal Reserve minutes that again pointed to diverging points of view on the committee.

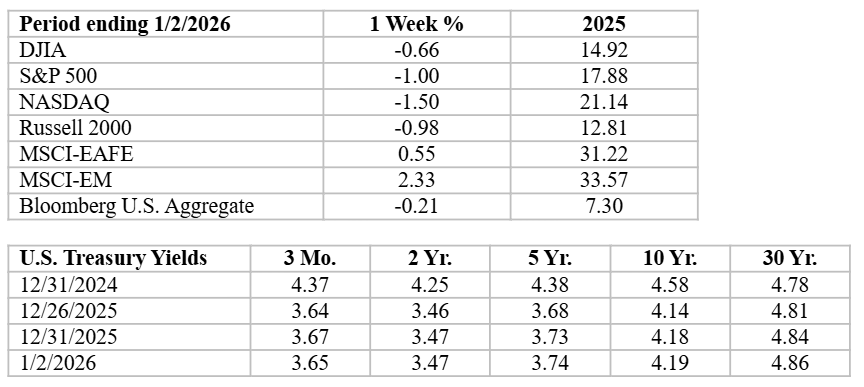

Equities were mixed for the week, with U.S. down and international higher. Bonds lost ground as yields ticked higher. Commodities were mixed as energy rebounded with geopolitical ties, and metals were mixed.

What to know about the markets:

U.S. stocks fell back during the lighter-volume holiday week, although the full year 2025 provided the third straight year of double-digit above-average returns. By sector, energy led the way, with 3% gains along with stronger oil prices. Most other sectors were flattish, while consumer discretionary was down by -3% (mostly due to Tesla), and technology and financials down by over a percent each. As the year drew to a close, hopes for AI continued to boost sentiment for growth stocks, while cyclical and value stocks appeared to gain some additional traction upon hopes that fiscal tailwinds will keep the economy expanding at a decent pace into the new year, which is expected to flow through to earnings, at least in early estimates.

Foreign stocks bucked the trend, with gains last week, particularly in emerging markets. In Europe, signs of an improving economy helped sentiment, despite the negative impact of a stronger dollar last week. Emerging markets were again led by strength in South Korea and Taiwan, which tend to be technology-heavy and related to enthusiasm for AI as of late. A key story of 2025 was one of international stock re-emergence, as prospects abroad appeared more favorable towards future growth than they have in some time—explaining the shift in sentiment in their favor.

Bonds fell back last week as interest rates ticked up a bit across the U.S. Treasury yield curve. Governments outperformed investment-grade corporates a bit, although high yield and floating rate bank loans outgained all others with flattish to mildly-positive returns for the week. Foreign bonds were mixed, in keeping with their respective exposures to the stronger dollar, with local EM outperforming, and unhedged developed market debt falling back nearly a percent. As long-term bond returns have historically tended to closely follow their starting yields (as the majority of return is captured from coupon income), shorter-term results can vary a bit from that path, with interest rate volatility and credit spreads being the key drivers. Last year, bonds showed their usefulness with competitive, above-average returns.

Commodities were largely down for the week, with gains in industrial metals, energy flat on net, and a pullback in precious metals, which included one of the more volatile daily moves in some time for gold. Crude oil prices rose 1% last week to $57/barrel, due to some rising tensions with Iran, although the market broadly is seen as oversupplied, which can limit the normal impact of such tensions. As with most asset classes, year-end repositioning and ‘window dressing’ trades likely also played a role in some the wider movements, as allocators added and trimmed various positions to close the calendar year. The past year was one where gold was a big winner, although silver, platinum, and palladium followed suit to help the category. Early Saturday, President Maduro of Venezuela was captured by U.S. forces in a surprise action. The response on oil and gold in particular remains to be determined this week. Some of the oil factors offset each other, with early bullishness about the potential to boost Venezuelan production (mostly helping U.S. energy equities, expected to benefit there), but coupled with already-high global crude supplies tempering the enthusiasm somewhat. Gold and silver rallied with the obvious geopolitical uncertainty behind the U.S. plan to ‘run’ the country, with details scarce so far.

Our Weekly Economic Notes:

Notes key: (+) positive/encouraging development, (0) neutral/inconclusive/no net effect, (-) negative/discouraging development.

(0) The FHFA house price index rose 0.4% in October, following a downward revision for the prior month from flat to -0.1%. By region, gains were led by a 1.0% gain in West South Central (OK/AR/TX/LA), while East South Central (KY/TN/MS/AL) prices fell by -0.4%. Over the past year, the national index rose by 1.7%, below the rate of inflation, and even further below the 4.7% year-over-year gain from Oct. 2024. For the full year period, Middle Atlantic (NY/PA/NJ) prices rose 5.3%, bookended by a -0.7% drop in West South Central.

(0) The S&P Case-Shiller home price index rose 0.3% in October, on a seasonally-adjusted basis, and a -0.3% decline without seasonal adjustment. Seasonally-adjusted 1-month gains were highest in San Francisco and Phoenix, while Boston pulled back, and Detroit data was missing due to collection problems. Year-over-year, the 20-city national index gained 1.3%, down a tenth from the pace of the prior month. For the year, gains were led by Chicago (up nearly 6%), followed by New York and Cleveland; Tampa was the laggard, with prices down over -4% for the year. The small gain on a national level was described as one of the “weakest performances since mid-2023,” and continue to decelerate, now lagging inflation. “Elevated mortgage rates” leading to “the highest borrowing costs in decades” and inflation generally continue to weigh on consumer affordability buying decisions, as recent residential real estate market sluggishness was described.

(+) Initial jobless claims for the Dec. 27 ending week fell by -16k to 199k, well below the 218k median forecast. Continuing claims for the Dec. 20 week fell by an even stronger -47k to 1.866 mil., below the 1.902 mil. expected. Seasonal employment and seasonal adjustments have raised volatility that’s common this time of year in these weekly numbers, which should normalize somewhat in the new year. Aside from that, no major red flags are apparent in claims data at least.

(0) The FOMC minutes from the December meeting noted that “most” participants see further rate cuts “over time,” although “some” saw higher chances for policy “unchanged for some time” at the conclusion of the meeting. That generally sums up the feelings leading to the voting dissent. It was noted that “a few” participants were on the fence in December, and could have been ok with leaving rates where they were, but certainly were for future meetings, due to concerns about progress on inflation having stalled. Such commentary could hint at a natural pause in policy activity until the data settles out in one direction or another, hampered by late releases tied to the government shutdown last year. “Participants generally” felt that upside risks to inflation were still “elevated,” while downside risks to employment “elevated” as well, but “had increased since the middle of 2025.” This fine distinction appeared to tip the balance toward easing, but not without some disagreement. In particular, “several” participants noted that lowering rates while inflation stayed high “could be misinterpreted as implying diminished policymaker commitment to the 2% target,” which has been commented on by Chair Powell several times. However, most members appear to feel that inflation will be “a little lower” over time. Based on futures markets, the expected pace of 2026 cuts remains at about two, which would get policy down to around the 3.0% neutral rate.

Have a good week.

Have investment questions? We're here to help. Schedule a call a complimentary Basics of Investing Zoom Session here.

Centered Financial, LLC is a registered investment adviser offering advisory services in the State of California, Utah, Texas and in other jurisdictions where exempted. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. There is no assurance that the techniques, strategies, or investments discussed are suitable for all investors or will yield positive outcomes. To determine which strategies or investment(s) may be appropriate for you, consult your financial adviser prior to investing. Any discussion of strategies related to tax or legal planning is general and is not intended as tax or legal advice. Please consult appropriate tax and legal professionals for recommendations pertaining to your specific situation.

Sources: Ryan M. Long, CFA; Director of Investments; FocusPoint Solutions, Inc.

FocusPoint Solutions, American Association for Individual Investors (AAII), Associated Press, Barclays Capital, Bloomberg, Citigroup, Deutsche Bank, FactSet, Financial Times, First Trust, Goldman Sachs, Invesco, JPMorgan Asset Management, Marketfield Asset Management, Morgan Stanley, MSCI, Morningstar, Northern Trust, PIMCO, Standard & Poor’s, StockCharts.com, The Conference Board, Thomson Reuters, T. Rowe Price, U.S. Bureau of Economic Analysis, U.S. Federal Reserve, Wall Street Journal, The Washington Post. Index performance is shown as total return, which includes dividends. Performance for the MSCI-EAFE and MSCI-EM indexes is quoted in U.S. Dollar investor terms.

The information above has been obtained from sources considered reliable, but no representation is made as to its completeness, accuracy or timeliness. All information and opinions expressed are subject to change without notice. Information provided in this report is not intended to be, and should not be construed as, investment, legal or tax advice; and does not constitute an offer, or a solicitation of any offer, to buy or sell any security, investment or other product. FocusPoint Solutions, Inc. is a registered investment advisor.

Comments